Role-Play Based AML Training

Train Remotely

SSO Integration

HRIS Integration

Mobile LMS Access

Pricing starting at $9 user/per month

Trusted By

-1.png)

Training so immersive, your team forgets it’s compliance (but regulators won't).

How RevCore Works:

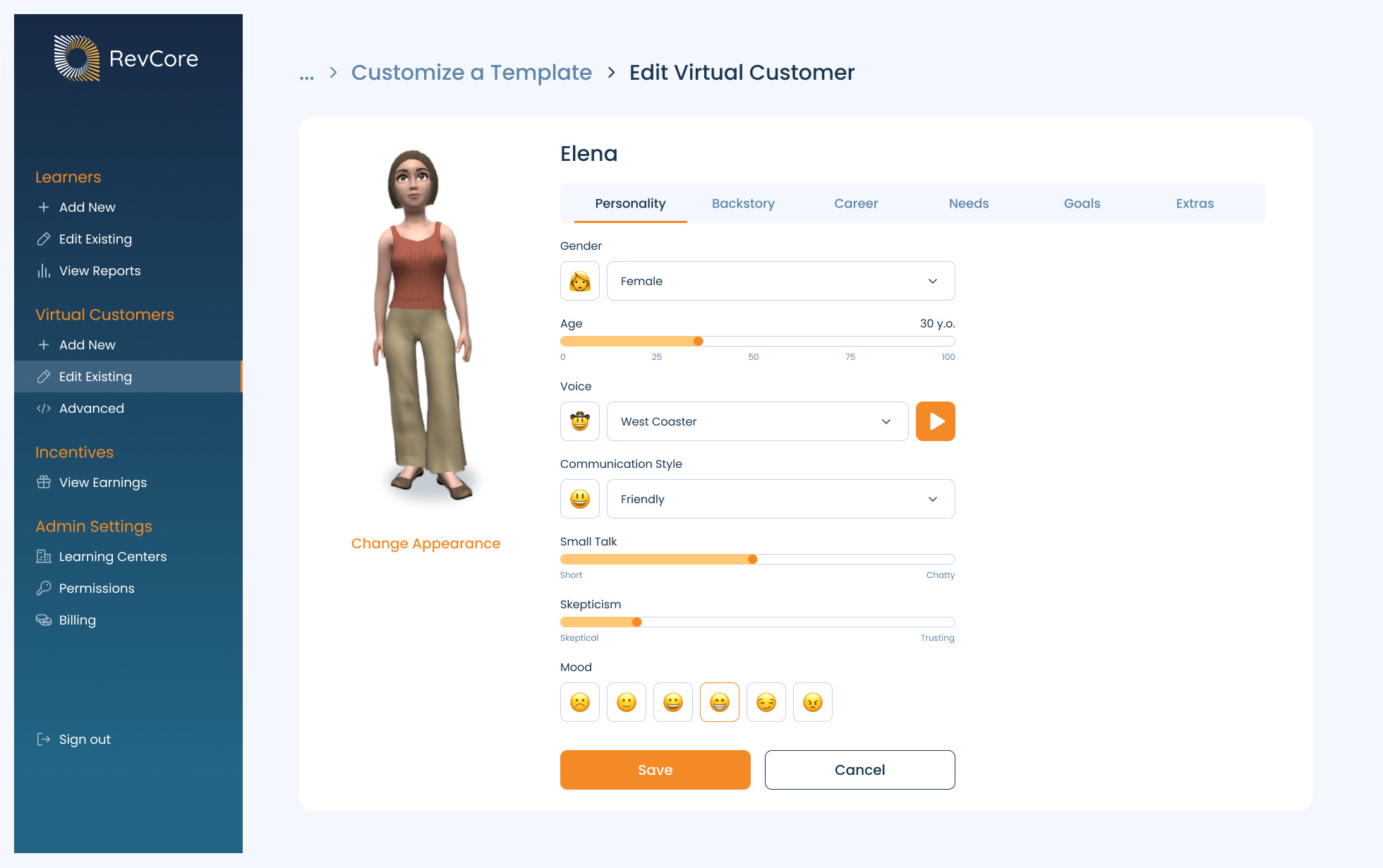

Build or customize scenarios that matches your customers

Customize any aspect - adjust age, tone, goals, personality, and objections for realistic training. Whether built from a template or started from scratch, the process takes minutes with no technical skills needed.

Your team practices with lifelike customers and challenging scenarios

Training with RevCore is as easy as speaking in a natural voice. Reps practice challenging situations using their natural voice - our AI quickly simulates how real customers would respond.

Trained with AI, your team is ready for anything - when it counts

Whether it’s calming irate customers, resolving disputes, or just making the customer feel heard, RevCore gives your team the skills and confidence so they’re ready when it matters most.

Award Winning Platform

The best way to scale top-tier training across your team

.png?width=300&height=300&name=remote-tech-logo+(1).png)

RevCore’s fully customizable scenarios let you recreate your toughest AML challenges.

Fully Customizable Options Include:

Gender

Age

Voice

Appearance

Friendliness

Backstory

Issue

Goal

Resolution Needed

Assessment Criteria

Assessment Weighting

Suggestions

And more!

Quick-Start AML Scenario Bundles

Start fast with pre-built practice scenarios based on the real workplace situations teams struggle with most. All fully customizable to meet your organization's specific requirements.

-

Role-Play Based AML Training

- Suspicious Cash Deposits

Scenario: A familiar customer arrives with multiple envelopes of cash, each just under $10,000, and makes light conversation while you process the deposits.

Goal: Engage the customer politely while recognizing the structuring pattern, verify transaction details, and communicate your need to escalate discreetly without arousing suspicion. - Unusual Wire Transfers

Scenario: A new small-business client calls requesting several same-day international wire transfers to unrelated recipients and pushes to “get it done fast.”

Goal: Speak with the customer to confirm the purpose of each wire, apply enhanced due diligence questions naturally, and document findings before proceeding. - Customer Refuses ID Verification

Scenario: A walk-in customer becomes defensive and raises their voice when you request identification for a large cash transaction.

Goal: Calmly explain the verification policy, de-escalate the tension, and maintain professionalism while enforcing ID requirements. - Foreign Beneficiary Anomaly

Scenario: A long-time retail customer suddenly asks to send a large transfer to an unfamiliar offshore beneficiary.

Goal: Ask conversational, open-ended questions to understand the purpose, confirm consistency with their profile, and explain why additional due diligence is required. - Shell Company Concerns

Scenario: A representative for a new corporate client hesitates to share details about ownership and insists the paperwork “isn’t important.”

Goal: Communicate the regulatory necessity of naming beneficial owners, build rapport while maintaining firmness, and delay account setup until full details are obtained. - Suspicious Real Estate Transaction

Scenario: A client insists on using third-party checks to fund a real-estate purchase and becomes impatient when questioned.

Goal: Speak directly about source-of-funds requirements, clarify that verification protects all parties, and pause the process until compliance clears it. - High-Risk Business Type

Scenario: A new client applying for a business account casually mentions they operate a cash-heavy venture like a car wash or ATM network.

Goal: Engage the customer with friendly but targeted questions about operations, confirm documentation, and explain the monitoring steps required for high-risk accounts. - Charitable Organization Misuse

Scenario: The treasurer of a small nonprofit proudly describes a sudden surge in donations and requests a large overseas transfer.

Goal: Show interest while asking validating questions about donation sources and recipients, confirm records, and explain compliance checks in a supportive tone. -

Refusal to Provide Source of Funds

Scenario: A client initiating a large transfer becomes evasive when you request documentation of the fund source, saying “you’re overcomplicating things.”

Goal: Maintain a respectful but firm conversation, restate regulatory obligations, and politely decline to proceed until documentation is complete.

- Suspicious Cash Deposits

Clicking "Next" Is Not Learning

No More Checkbox Compliance

Banking

Banking

Fintech

Fintech

Insurance

Insurance

Brokerage

Brokerage

Payments

Payments

Accounting

Accounting

Legal

Legal

Insurance

Insurance

Trust Services

Trust Services

Crypto

Crypto

About RevCore by RemoteBridge

RevCore is built by RemoteBridge, a company dedicated to helping HR and team leaders train great teams using immersive AI and 3D technology.

No goggles, no downloads—just real training that works.

We’re not just building a business—we’re making work and training less stressful, more engaging, and even a little fun.

Thank you for joining us.

Alex Sheshunoff

CEO & Co-Founder

RevCore is priced for your needs and budget

RevCore Includes:

- Authentic Role-Playing with AI

- Anytime, Anywhere Accessibility

- Fully Customizable Scenarios

- Progress Tracking & Performance Analytics

- Certificate of Completion

- SSO, LMS, and HRIS Integrations

- Motivate with Rewards and Gamified Elements

- Industry Leading Certifications

- Natural Language Processing and Feedback

.png?width=1300&height=397&name=Logo%20Lockup%20Orange%20(1).png)

.png?width=720&height=220&name=Logo%20Lockup%20Orange%20(1).png)